Simple SaaS: The 3 most important metrics for investors

It’s easy to love the SaaS business model, especially with the all the recent hype. Integrated mission critical software, high margins, recurring revenue, growing industry, and exit multiples based on revenues. It’s no surprise that venture funds and private equity funds are racing around to find the next Salesforce.com.

But not all SaaS businesses are built equally. Bill Parcells, the head of football operations for the (11-5) Miami Dolphins and former Super Bowl coach, says it best: “You are what your record says you are.” As investors, we thought it would be helpful to share the three most important metrics we look for on the surface to help us quickly size up your software business.

Monthly Recurring Revenues (MRR)

The first question any investor will ask: what is your MRR? This is often followed by a few others: how many customers do you have? What’s your average MRR per customer? How quickly did you sign up these customers and what does the pipeline look like? The VC will quickly do the math and figure out where your MRR will be 24 to 36 months out.

Churn

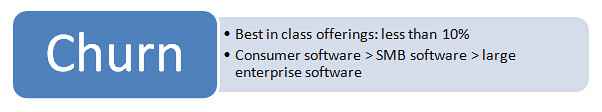

The next key question is churn, or the number of customers who unsubscribed from your service. Churn is a very complicated question and reveals so much about a company and its management team. High churn may indicate that you have a lot of competition, a low value proposition, weak customer service, or it might indicate you have a transaction-focused customer or even a customer that was never really a customer. As an example, one of my portfolio companies offers a transactional service in additional to an enterprise solution. To be fair, we should only measure the churn on our enterprise clients. Digital Menubox had a hardware product but now offers a complete platform as a service. In this case, we need to measure churn on customers with and without the full solution.

The raw figures for churn aren’t helpful to investors unless they are measured by product and cohort, which allows you to track changes over time with subsequent product iterations. As a rule of thumb, best in class SaaS offerings typically have churn below 10%. VCs realize that products aimed at individuals and small businesses will experience higher churn than large enterprise solutions. Our only advice is that 10% churn is not necessarily better than 0% churn. For example, Nulogy will have 0% churn but a much longer implementation cycle. Digital Menubox might have a higher churn, but implements 50-100 new customers per month. Neither model is better than the other.

Customer Acquisition Cost (CAC)

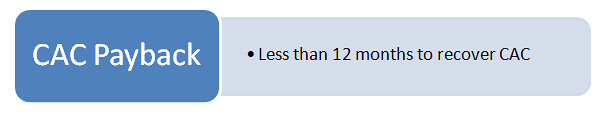

The last key metric we look for is the cost to acquire a customer. We all have different ways to measure cost, but we truly believe in being honest with yourself. At Digital Menubox we factor in the hardware, a replacement reserve, sales commission, design cost, and shipping cost. We truly want to understand the payback. With all our companies, it comes down to cash flow and the only way to know your cash requirements is to fully understand the cost to acquire the customer and the lifetime value of the contract. Our simple rule is that if the payback is greater than one year, you will likely run out of money and your business model is probably not sustainable. As a reference point, my current portfolio averages a little under 8 months.

One of the great things about the SaaS model is that everything is measurable, and you can constantly refine the business process and product to improve your metrics. The challenge is the capital required to successfully build your software and collect your revenues over 3+ years.

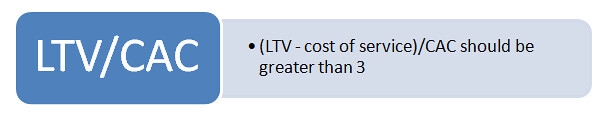

For the math to work, it boils down to these simple metrics. These three metrics above will determine your Lifetime Value (LTV)/CAC. We measure LTV/CAC as the expected contracted revenues of one customer (after factoring the churn) minus the cost to service a customer (over its expected lifetime) divided by the true cost to acquire and maintain the customer (CAC). If we have a sustainable business model with a 3x (or more) LTV/CAC ratio, we know we have a winner. It’s just math!

While the numbers never tell the whole story, they ultimately determine the worth of a SaaS business in the eyes of investors. Always keep these metrics in mind when you are building out your business and use them as part of an honest self-assessment to make sure you are staying on track. My favourite blog post on this topic is by David Skok at Matrix Partners, who looks at even more metrics than the basics discussed here: www.forentrepreneurs.com/saas-metrics.

Daniel Klass is an experienced private equity investor having spent time at TD Capital and EdgeStone Capital Partners before raising his fund Klass Capital. Daniel and the team at Klass Capital focus on small to mid sized web-enabled businesses seeking to invest $500,000 to $5,000,000 of growth capital. You can follow Daniel on twitter @klasscapital.